Fiduciary Retirement Financial Advisors in Las Vegas

We help those newly—or nearly—retired LIVE RICH and FEARLESS!

The “Stress-Free” Retirement of Your Dreams is Not a Myth

You worked, you saved, you made it to retirement . . . What now? Now the real work begins because once you retire you can’t earn it again!

Most retirees won’t enjoy the retirement they dreamed of for fear of dying broke. They travel, spend, and enjoy less than they could because they don’t have the time, skill, and desire to create and execute a masterful retirement plan.

That’s where we come in . . .

Live The Retirement You Always Dreamed Of

We’ll design a plan to maximize your retirement dreams, squeezing every last dime from your finances to help you reach them.

Stop Worrying About Money

We’ll plan for the best but prepare for the worst, alleviating the worry and stress other retirees suffer daily.

Find Financial “Peace”

Creating and implementing your plan is only half the battle. We regularly monitor and manage your plan results to help ensure you stay on track.

Would An Extra Million Dollars Help Your Retirement?

Learn how we improved a client’s plan by ADDING NEARLY ONE MILLION DOLLARS to accomplish their lifetime goals and dreams.

Our clients enjoy

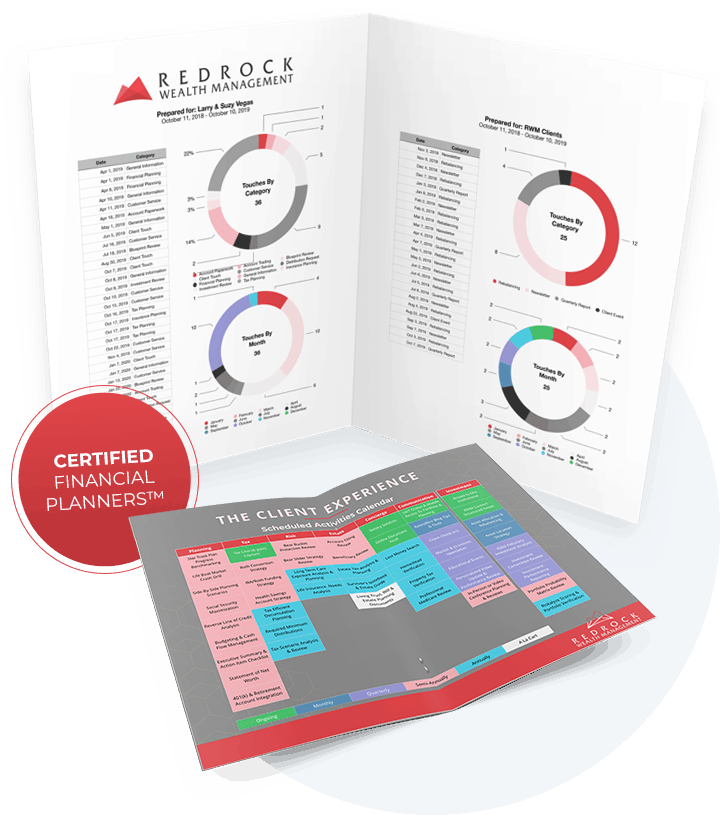

A comprehensive schedule of client planning & management activities

Full accountability with our “Advisor/Client Report Card”

A “confidence-inspiring” relationship “ee-based financial advisors can’t mimic

Easily accessible and highly attentive CERTIFIED FINANCIAL PLANNERS™

A “one-stop-shop” delivering real and lasting financial peace and confidence

You have two choices. You can continue down the same path of empty promises and overpriced insurance and investment products living in constant fear that you’ll die broke, or you can

Click “Start Here Now” Below & Tell Us About Your Unique Situation

You’ll Get A Custom Proposal & Link To Schedule a FREE Money Strategy Session

If We’re A Match, We’ll Get To Work Immediately!

What Makes Redrock So Special?

It’s All About Our Fiduciary Commitment To Help You Enjoy Retirement Stress-Free!

Your trust and confidence is our most treasured—and irreplaceable—asset. We realize your trust and confidence must be earned.

We’re completely independent with no proprietary insurance or investment products

We’re pure Fee-Only (no commission—or fee-based—financial services) so our interests are perfectly aligned with your financial and retirement success

We embrace our fiduciary responsibility in writing (ask your current financial advisor to do that, they won’t because they’re not true fiduciary advisors!)

We work for you NOT Wall Street! No insurance or investment company will tell us what’s best for you, we’ll decide that together

We’re skilled and experienced. Our Las Vegas and Boise financial advisors are all CERTIFIED FINANCIAL PLANNER’s™. Collectively, we put our 50+ years of experience to work for you!