THE RETIREMENT NAVIGATION PROGRAM

The Retirement Navigation Program is our flagship ongoing service for Private Clients. If you want to implement, monitor, and manage your retirement finances on your own, this is not for you!

If you want professional fiduciary industry experts to do this for you, the Retirement Navigation Program may be a great fit!

HOW DOES THE RETIREMENT NAVIGATION PROGRAM WORK?

The first phase of the Retirement Navigation is the Retirement Architect Program. The Retirement Architect Program is where we design and optimize the retirement of your dreams so you’ll have more money and less worry. Only after that foundation is set can we proceed with implementing it.

The second phase is the Retirement Navigation Program. This is where we execute the fine details of your unique retirement plan. A plan without brilliant execution is simply a waste of time and money.

IMPLEMENTING YOUR RETIREMENT NAVIGATION PROGRAM

Putting your plan to work is a painstaking and intensive process of:

- Establishing, transferring, and managing your investment accounts

- Scheduling, monitoring, and maintaining your retirement income distributions

- Ensuring your estate & beneficiary designations are properly maintained

- Creating a structured series of planning and portfolio reviews

- Monitoring, tweaking, and rebalancing your investment portfolio

- Constantly searching to minimize your tax obligations through Roth Conversions, asset LOcation, tax-loss (and tax-gain) harvesting

Creating, managing, monitoring, and maintaining your ultimate retirement plan isn’t easy. It’s time-consuming and requires constant attention to squeezing every last dime from your retirement finances. While it’s not easy, it’s our passion!

MONITORING AND MANAGING YOUR RETIREMENT NAVIGATION PROGRAM

Once your retirement dreams are fully mapped out and agreed upon, we schedule a series of periodic reviews, and financial plan management. Some of those tasks are in-person (or via video conference) with you. Others are “behind the scenes.”

Most commonly, we’ll meet twice per year for a thorough review of your Retirement Navigation plan. We encourage great questions and dialogue especially early in our ongoing relationship, so we may meet 3-4 times or more during the first couple of years of working together.

During those in-person planning reviews, we’ll update your financial planning with any money or life changes you may have on your journey towards both a memorable—and purposeful—retirement. A great plan for retirement will always face challenges and changes, but we’re always available for our Retirement Navigation clients when those things arise.

Behind the scenes we’ll be:

- Allocating, monitoring, and maintaining your investments according to your financial plan requirements

- Searching for tax-loss (and tax-gain) harvesting opportunities

- Looking for strategic Roth conversion opportunities throughout the year

- Ensuring your retirement income spending strategy is meeting your needs

- Developing and refining our professional knowledge and skills to better serve your needs

- And a lot more!

There’s a lot that goes into the Retirement Navigation Program. We rely heavily on world-class software and technology to ensure we execute to the best of our abilities and in-line with your retirement planning needs and goals.

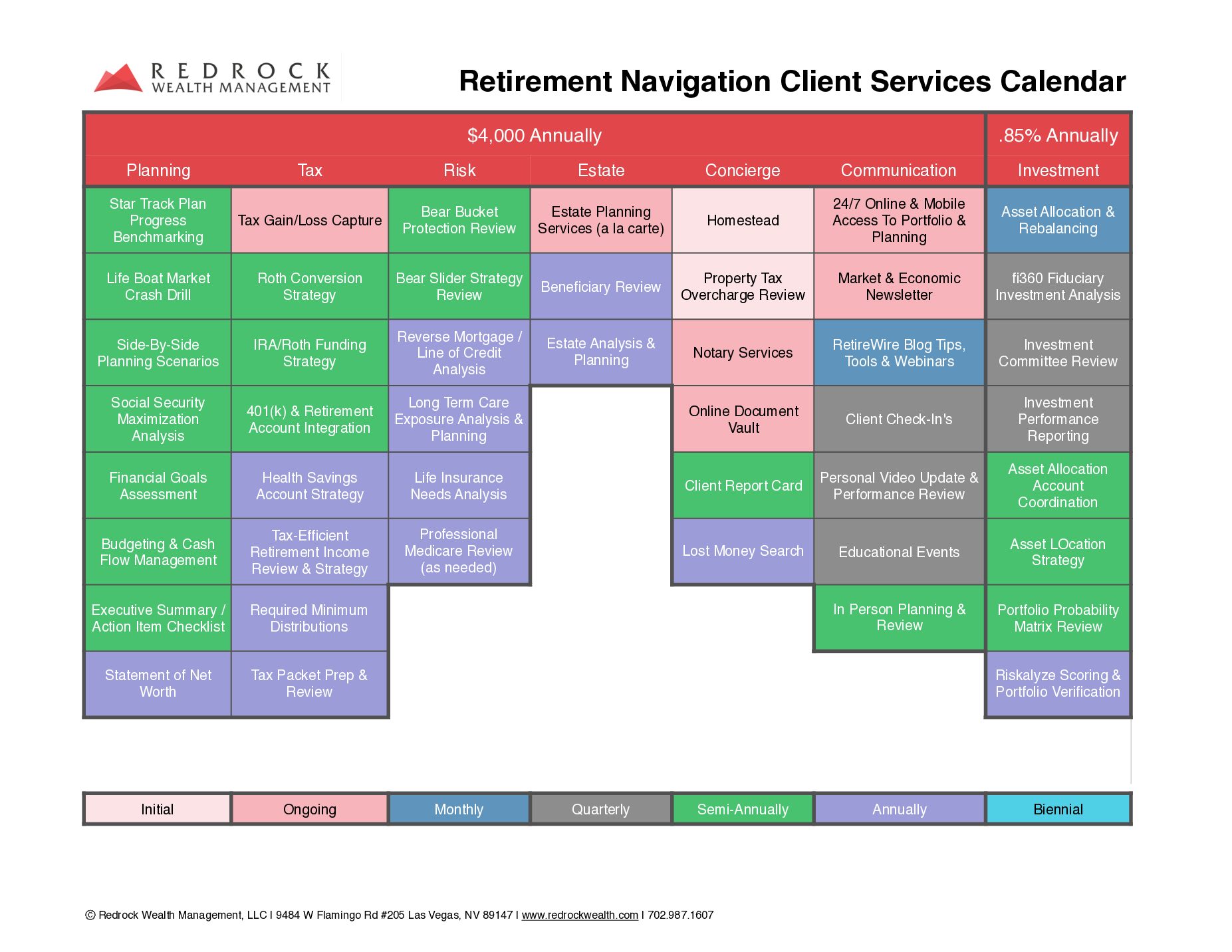

THE RETIREMENT NAVIGATION CLIENT SERVICES CALENDAR

Our entire process is best summed up in our Client Services Calendar. While not everything on this schedule is applicable to you, most of our clients enjoy the bulk of the systems and processes we’ve created to better serve you.

frequently asked questions

WHAT DOES THE RETIREMENT NAVIGATION PROGRAM COST?

For a customized proposal, please click here. All fees are charged quarterly directly from your investment accounts.

ARE THERE ANY LONG-TERM COMMITMENTS?

While we ask every Retirement Navigation Private Client to give us at least a year to add value to your planning, you can hire and fire us at will. This is fine by us, because unlike most “financial advisors,” we wake up every morning knowing we must deliver you maximum value or we’ll be fired.

Many “financial advisors” love to sell fat commission products then don’t care if you fire them because they already got the big payday. We don’t accept big fat commission paydays to sell you insurance and investment products like most other financial advisors here in Las Vegas.