Life insurance is a crucial component of your financial plan. The reality is that there is no one size fits all solution for your life insurance needs. Before we move any further, we are not life insurance salesmen. Redrock does not sell life insurance of any kind, but rather we advise our clients on the best policy for their situation in the event they need it.

There are a plethora of reasons why you should consider life insurance. Maybe you want to leave an inheritance for your heirs or maybe use life insurance to help pay off debts such as your mortgage, credit cards, etc.

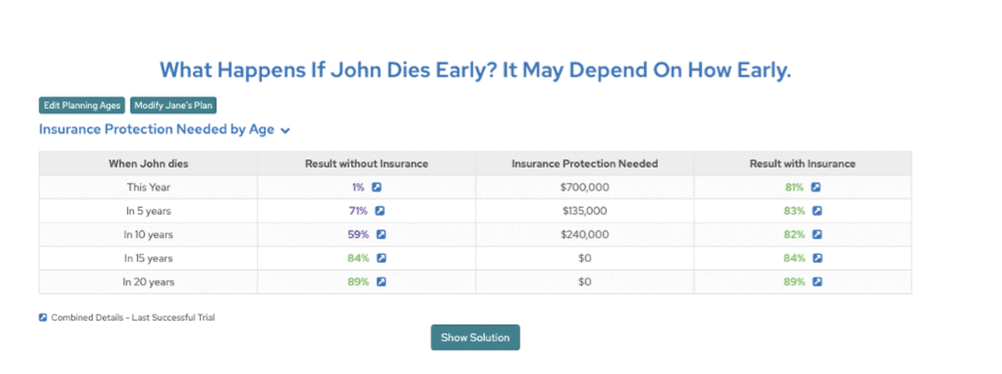

To give you an idea of how important life insurance planning can be for your overall financial plan, see the example below.

In this case, we have a client who has a significantly higher income than his spouse who we don’t want to leave in the dark should he pass away early. With a simple insurance needs analysis, we discover that if he were to die this year, her probability of success for accomplishing her goals is only 1%. This makes sense given the loss of household income and we still want her to be able to live her life without having to cut back on her goals and activities.

As you can see, had she had a life insurance policy on her husband, in this case, a 10-year term insurance policy with a death benefit of $700,000, then her probability of success dramatically increases to 81%.

Typically, we recommend term insurance for our clients. Term insurance premiums are inexpensive relative to other types of policies and you will get the most “bang for your buck”.

Term will cover you for a fixed period of time., i.e. 10, 20 or 30 years. Unlike other types of insurance such as whole life, there is no other value. In the event you pass away within the term, your beneficiaries receive the death benefit.

Going through the financial planning process will expose your insurance needs and we will be able to help you figure out exactly which policy is best for you and how much insurance you will need.

0 Comments