Are You An Evidence-Based Investor?

INVESTMENT PLANNING

It’s foolish for an investment planner to solely complete a simple risk tolerance questionnaire and cherry pick an investment portfolio – it’s simply not enough information. For this reason, we base every client’s investment plan off of their financial plan.

There are three components to every great investment plan – two of which are factors of your financial plan and one is simply a subjective “guesstimate”:

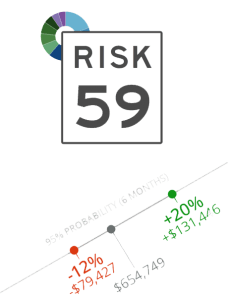

Investment Risk Tolerance

This is a subjective “guesstimate”. Your risk tolerance is nothing more than how emotionally stable you are during bad market cycles. Unfortunately, until you live through those bad market cycles, you won’t really know how “risk tolerant” you are. In good markets, your risk tolerance is higher, and in bad markets your risk tolerance plummets. Your risk tolerance is a small factor in your overall investment plan, which is why we focus on your risk capacity and risk required—two factors of your financial plan.

Investment Risk Capacity

Your risk capacity is the amount of investment loss you can withstand and still achieve your financial goals. You may be tolerant of a 20% drop in a bad stock market; however, your financial plan may be completely derailed! We work to match your risk capacity with your financial plan to make sure you can withstand those inevitable market drops without your financial plan imploding!

Investment Risk Required

A 20% drop in your investment portfolio may be completely unacceptable to you emotionally, but that level of risk and volatility may be required to achieve the returns necessary to meet your financial goals. If your financial goals are so lofty your investments must produce a return of 4% over the inflation rate, you must be willing to accept an investment portfolio with a commensurate level of risk OR reduce your financial goals OR increase your savings.

Any quality investment plan must be driven by your ultimate financial needs and desires for the future. Anything less than a comprehensive personal financial plan will inevitably put you at greater risk of not achieving your financial goals.

Does Investment Planning Make Your Head Spin?

Call Us! 702-987-1607

When you’re ready for a custom investment plan that’s constantly evolving with your financial needs and goals for the future, we’re ready to create one for you!